On Monday, U.S. stocks caught a breather from last week's sell-off. With the Federal Reserve entering its quiet period, the market anticipates that the release of several economic data points this week could clarify the outcome of next week's meeting. Some observers analyze that the Fed's monetary policy and economic uncertainties remain the main factors causing short-term turmoil in the U.S. stock market.

"Bad news is bad news"?

As the interest rate cut approaches, market expectations have shifted from the easing period's "bad news is good news" to the economic trial's "bad news is bad news."

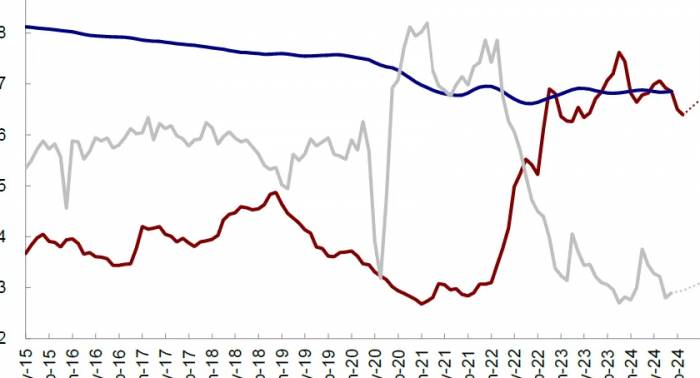

This month, long-term U.S. Treasury yields have plummeted significantly, with the 2-year Treasury note, closely linked to interest rate expectations, hitting a new low since September 2022, and the benchmark 10-year Treasury note falling to 3.71%, reaching a low not seen since June 2023. Employment data have reignited investors' concerns about a slowdown in the U.S. economy and expectations for aggressive rate cuts.

The Job Openings and Labor Turnover Survey (JOLTS) released by the U.S. Department of Labor last week showed that job openings, a measure of labor demand, dropped to 7.673 million, the lowest level since January 2021. In the crucial non-farm report, the addition of jobs in August also fell short of expectations, combined with downward revisions to previous data, indicating that the labor market is losing momentum.

Boris Schlossberg, a macro strategist at asset management firm BK Asset Management, said in an interview with First Financial that although the job market has not collapsed as feared by outsiders, it is still noticeably weak. In the past three months, the average monthly increase in non-farm jobs has been 116,000, a significant slowdown compared to the average pace of 207,000 in the first half of the year. The current "Sahm Rule" indicator stands at 0.57, still above the historical threshold associated with economic recessions. Therefore, it is understandable that investors' concerns about a hard landing for the U.S. economy have been rekindled.

Last week's stock market movement mirrored the panic in early August, with the CBOE Volatility Index (VIX) surging nearly 50%, returning to above the long-term average of 20. In addition to cyclical sectors being constrained by economic headwinds, the cooling of risk appetite also put pressure on the highly valued technology sector, with the Nasdaq falling more than 5% for the week, and the artificial intelligence industry, represented by Nvidia, facing significant selling pressure.

According to the economic forecast updated by the Atlanta Fed on Tuesday, the annualized quarter-on-quarter growth rate of the U.S. domestic market's Gross Domestic Product (GDP) for the third quarter is expected to be 2.5%, a slowdown from the 3.0% growth rate in the second quarter.

Peter Boockvar, Chief Investment Officer at Bleakley Financial Group, said in a report that the U.S. economy is cooling down, and the manufacturing sector is still in recession, with little sign that things will change soon, but it remains to be seen to what extent rate cuts will help bring more economic activity. He wrote, "As for the stock market, we will see more evidence that bad economic news is bad for stocks, and vice versa."

Can rate cuts change the market's predicament?In Schlossberg's view, the market is concerned with the certainty of the economic outlook. "From a macro perspective, whether it's a soft landing or not depends on the subsequent actions of the Federal Reserve. Although we cannot say that a recession is imminent, the risk of policy mistakes cannot be ignored," he further analyzed, "On the other hand, from the perspective of market pricing, a 25 basis point rate cut has been fully digested, so the good news of a conventional rate cut may become a catalyst for capital to take profits. If a 50 basis point cut is chosen, it means that the economic situation has deteriorated, and selling will be inevitable. Therefore, no matter how the Federal Reserve decides, what drives the market more is still the certainty of the economic outlook."

Last week, a new round of selling once again touched the nerves of investors, and the latest judgments of Wall Street institutions have also diverged. Deutsche Bank believes that investors should not worry too much about the economic slowdown, and panic may be unfounded. Deutsche Bank's macro strategist, Henry Allen, said in a report: "We should not worry too much about how bad things are. Even before this sell-off, we already knew that September is a seasonally weak month, and the stock market often struggles before the end of the U.S. election."

Allen wrote that it is also worth noting that in the past few months, most global central banks have only cut rates by 25 basis points, indicating that the current global economic situation does not seem to have "universal panic." "The fact that other institutions such as the European Central Bank have only taken action by 25 basis points indicates that they do not currently believe this is a situation that requires rapid adjustment."

Bank of America's Chief Investment Strategist, Michael Hartnett, is relatively cautious. He tends to think that the probability of a hard landing is underestimated, and even if the Federal Reserve only cuts rates by 25 basis points for the first time, there will still be a significant rate cut later. This star analyst suggests that investors' operations should be "sell the first rate cut" and wait for a better entry point.

According to Dow Jones Market Data, since the early 1990s, the Federal Reserve has gone through five rate-cutting cycles. On average, the S&P 500 index has risen by 2.5% three months after the first rate cut. However, this conceals the intense reaction after the rate cuts in 2001 and 2007, when the index fell by double digits one year after those rate cuts.

Morgan Stanley's equity strategist, Michael Wilson, observed that the spread between the 2-year Treasury yield and the federal funds rate has reached about 190 basis points, matching the widest level reached in the past 40 years. "This pricing indicates that the bond market believes that the Federal Reserve is behind the curve." Now Wilson is worried that the stock market is also increasingly skeptical about this, whether a 25 basis point rate cut is enough to deal with weak employment data.

Morgan Stanley believes that volatility will continue to rise in the short term, and the fair value price-to-earnings ratio of the S&P 500 index is 19 times, which corresponds to a range of 5,000 to 5,400 points for the index.

Share Your Experience