The last non-farm payroll data before the September FOMC meeting almost determined whether recession concerns would intensify and whether the Federal Reserve would cut rates by 25 or 50 basis points two weeks later. Its significance is self-evident. Powell's focus on the job market at the Jackson Hole meeting also fully illustrated this point.

However, the results were not as clear-cut as the market expected to "determine the outcome," but rather more confusing. The performance of various assets was also not uniform. As of the end of trading on Friday, the September rate cut expectation of 25 basis points implied by CME rate futures actually rose to 70%. The 10-year U.S. Treasury rate fluctuated and ultimately remained at 3.7%; gold jumped and then fell, U.S. stocks fell again, and the U.S. dollar index rose slightly, which also indicated that the market was entangled and there was a significant divergence.

How much is the recession pressure? Is a 25 basis point or 50 basis point rate cut enough to cope with growth pressure, and how will the market react? How much expectation has been priced into various assets? These are all issues of market concern and are urgent to be answered.

The non-farm information: It is indeed not good, but it is not bad enough to "determine the outcome"; it is slowing down but not in recession.

In July, when the unemployment rate rose to 4.3%, triggering the so-called "Sam Rule," and Powell expressed the importance of the job market for subsequent rate cuts, this month's non-farm data almost determined whether recession concerns would be intensified and whether the Federal Reserve would cut rates by 25 or 50 basis points two weeks later. However, the data results were "mixed," allowing both optimists and pessimists to find reasons, but neither could "determine the outcome": 1) The downside: The new non-farm employment was 142,000, not only lower than the expected 165,000, but also the previous month's data was significantly revised down from 114,000 to 89,000. 2) The upside: Temporary unemployment decreased by 190,000, basically making up for the gap of 249,000 temporary unemployment caused by weather and other factors in July. In addition, the household survey employment increased by 168,000, reducing the unemployment rate from 4.3% to 4.2%, and wages also rose more than expected to 0.4% (expected 0.3%).

Considering that the large number of temporary layoffs affected by weather and other factors last month are likely to dissipate, the market had fully expected some recovery this month before the data was disclosed. Therefore, if there is a better-than-expected recovery, it can alleviate recession concerns and eliminate the expectation of a 50 basis point rate cut; if it is significantly lower than expected, it will further intensify recession concerns. However, the final result was a drop in the unemployment rate, and the recovery of new employment was less than expected, which means that the job market is indeed slowing down, but it may not be enough to confirm a recession.

As for the significant revision of the data, it does indicate that the job market is weaker than the previous data showed, but an objective fact is that the job market is subject to survey methods and response rates, which makes the quality of the monthly data uneven and often faces significant revisions. The current revision is not abnormal compared to historical dispersion.

After the non-farm data, next week's CPI data may also be "lukewarm." We estimate that the overall CPI in August increased by 0.12% month-on-month, lower than the expected 0.2% and the previous value of 0.15%, with a year-on-year increase of 2.52% (in line with expectations of 2.6%, previous value of 2.89%); but the core CPI increased by 0.19% month-on-month, basically in line with expectations of 0.2%, higher than the previous value of 0.17%, with a year-on-year increase of 3.17% (in line with expectations of 3.2%, previous value of 3.17%). Since Powell has already clearly hinted at the Jackson Hole meeting that the importance of inflation in future rate decision-making may decrease, the data may not be enough to eliminate the expectation of a rate cut if it exceeds expectations, but a significant undershoot may have a substantial impact.

The number of rate cuts: 25 and 50 basis points are both possible, but 25 basis points is still the benchmark; the effect of easing has actually begun to show.

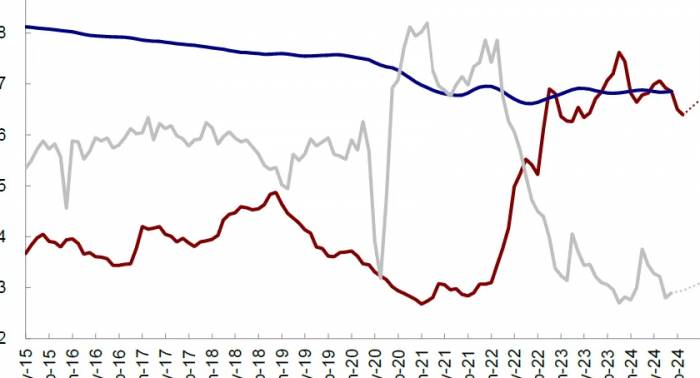

In fact, this data has provided the Federal Reserve with some room for maneuver and space. In the case of slowing growth without evidence of a recession, market expectations show that a 25 basis point and a 50 basis point rate cut are both possible, and "reasonable" arguments can be found for both. Although a 25 basis point rate cut may not be enough to "convince" the market to eliminate recession concerns, a direct 50 basis point rate cut may lead to recession concerns.We believe that 25bp is still the baseline scenario, not only because we do not think that the current situation is a deep recession, but also because even if there is no interest rate cut, the easing effect has actually begun to show, as reflected in: 1) Real estate: After the 30-year mortgage rate quickly fell to 6.4% following the 10-year US Treasury bond, it has been lower than the average rental return rate of 7%, which has led to a rebound in US existing and new home sales in July after a lapse of 5 months. US existing home sales have grown for the first time in 5 months, and the leading new home sales also increased by 10% month-on-month in July. In addition, refinancing demand has also rebounded with the decline in mortgage rates. 2) Direct financing: The credit spreads of investment and high-yield bonds are at historical lows of 14.6% and 32.7% respectively. Coupled with the sharp decline in benchmark interest rates, the financing costs of enterprises have also fallen rapidly. Against this background, starting from the decline in interest rates in May, the cumulative year-on-year growth of US credit bond issuance from May to August was 20.6%, investment-grade bonds increased by 13.7%, and high-yield bonds increased by 74.5%. 3) Indirect financing: The proportion of banks that tightened loan standards in the third quarter has dropped significantly, and the residential loan standards have even turned to relaxation (the proportion of banks that tightened-relaxed was -1.9%). Based on the starting point of interest rate cuts to solve the problem of high financing costs in various links, we estimate that statically, this round of interest rate cuts of about 100bp (4-5 times) can have an effect. However, the easing of the above financial conditions has not yet been reflected in the actual macro hard data, which is not only the "gap" between slowing growth and loose policies, but also the reason for the confusion and volatility of market expectations at this stage. Market transactions: The expected inclusion degree is interest rate futures>gold>copper>US bonds>US stocks; "think the opposite, do the opposite", gradually switch after fulfillment, and gradually improve in the fourth quarter As discussed above, the current US economy has slowed down, but the Federal Reserve has not yet started to cut interest rates, and is in a stage of "gap" between data and policies. At this stage, economic data has not yet fallen to the level of recession, but the effect of loose financial conditions has not yet fully emerged, so we believe that asset fluctuations are also normal, similar to before the first interest rate cut in 2019. In this sense, the decline of US stocks and gold on Friday, the rebound of US bond interest rates after a drop, and the confusion of rising expectations of interest rate cuts can all be summarized as the contradiction that the market is worried about recession and expects a larger interest rate cut, but cannot find conclusive evidence to prove the recession. Therefore, US stocks fell in the former, while gold and US bonds fell in the latter. In essence, this is the market playing a game between the size of recession pressure and the magnitude of interest rate cuts. If a new consensus is formed (such as waiting for the interest rate cut to be realized, or the economic data to improve), and a new balance is reached, the transition is basically completed, and assets should be switched from gold and US bonds to industrial metals and stocks. This is the case with the interest rate cut cycle in 2019. In 2019, the fundamentals of the United States were also a small interest rate cut under a soft landing, and the same situation of inverted interest rate spreads and weak economic data occurred. The 10-year US Treasury bond interest rate began to decline before the Fed cut interest rates, from a high of 3.2% to 1.5% after the first rate cut, which also became the low point of this cycle. During the downward trend of US Treasury bond interest rates, economic expectations were unstable, risk assets pulled back several times, and gold rose, which is exactly the same as the current situation. Against this background, US stocks pulled back by 6.8% and 6.1% before the rate cut in May 2019 and the first rate cut in July 2019, respectively. But the quiet change behind it is that the decline in long-term bond interest rates has prompted the US existing home sales to start an upward cycle before the rate cut. After the Fed cut interest rates once in July 2019, inflation began to pick up, and economic expectations improved, causing long-term US Treasury bond interest rates to bottom out and rebound after the first rate cut. Gold peaked at the same time, and copper and US stocks gradually rebounded, rather than waiting until the rate cut ended before switching. This round is also generally the case. The expected rate cuts currently included in assets are already relatively sufficient, so unless new recessionary pressures break the balance, assets that may benefit from rate cuts should be gradually considered. Therefore, we believe that unless there is sufficient evidence of the risk of a deep recession, it is not meaningful to trade in this direction in a linear extrapolation (such as US bonds and gold). The economy may recover again after the Fed cuts interest rates, and assets that may benefit from the rate cuts should be considered instead. Moreover, the amount of expectations factored into different assets also affects the reaction to the rate cut itself. We estimate that the current order of how much the rate cut expectations are factored in is interest rate futures (225bp)>gold (83bp)>copper (77bp)>US bonds (75bp)>US stocks (29bp). This is also the reason why the rebound of US stocks and copper from the bottom in August was more obvious than that of gold. This is also the main meaning of our suggestion to "think the opposite and do the opposite" moderately.For the US stock market, our financial liquidity model estimates that there is a potential for improvement in the fourth quarter, which aligns with the dense schedule of events in the next month or two, such as the second US presidential debate (morning of September 11th Beijing time, also the first debate between Harris and Trump and the last debate of this election cycle), US inflation data (evening of September 11th), and the September FOMC meeting (September 19th). Therefore, short-term fluctuations are normal, but a pullback could actually present a better opportunity for allocation.

Share Your Experience