Although the path to economic recovery is not smooth, Chinese companies have started to actively adjust their capital structures and transform towards more efficient business operation models.

According to the China Working Capital Index report for 2024 released by JPMorgan Chase on September 9, more than half of Chinese companies (53%) saw an improvement in their cash conversion cycle in 2023, with an average improvement of 1.6 days compared to 2022, and a decrease in cash levels by 8.9%. Among them, 77% of Chinese companies increased their accounts payable turnover days, while 64% reduced their inventory turnover days.

This China Working Capital Index report captures the operational cash trend of Chinese companies in 2023, covering a total of 400 companies from the CSI 300 Index, Hong Kong HSCEI 50 Index, and S&P 50 Index of Chinese companies listed in the United States.

By optimizing working capital management, Chinese companies can release liquidity potential up to $321 billion, which, once unleashed, will help companies better cope with external market fluctuations and invest in future business.

In 2023, domestic consumption in China gradually recovered, but demand growth slowed down, coupled with global regional conflicts and trade route disruptions, and other uncertain factors, the performance of the China Working Capital Index was basically in line with the previous year. This year, with the government introducing more support measures to boost consumer confidence, JPMorgan Chase expects that subsequent demand will strengthen, which will help further alleviate the earnings and working capital pressure on Chinese companies.

Overall cash levels of Chinese companies have decreased.

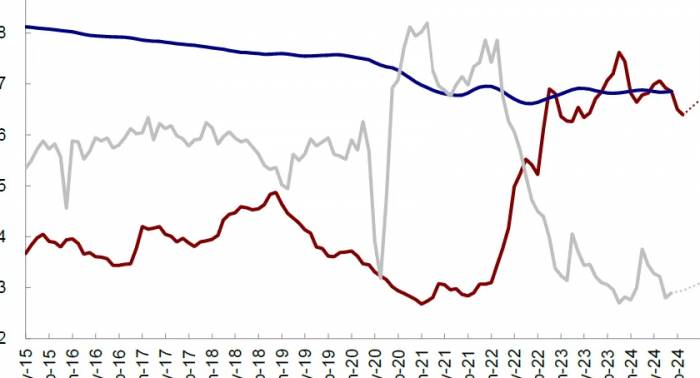

In terms of the cash conversion cycle, the difference between Chinese companies (77 days) and multinational companies in the S&P 1500 (75.8 days) is minimal. However, there are more significant differences in accounts payable turnover days, sales conversion days, and inventory turnover days. Compared to 2022, Chinese companies have seen a larger increase in accounts payable turnover days, so the cash conversion cycle for Chinese companies improved by 1.6 days in 2023, while the cash conversion cycle for S&P companies extended by 4.2 days due to further accumulation of inventory.

Some Chinese companies are trying to maintain their working capital levels and cash conversion cycles by extending payment times to suppliers. JPMorgan Chase believes that a more proactive approach is to improve inventory turnover days and accelerate business transformation and optimize investment strategies.

In addition, the cash levels of Chinese companies in 2023 are converging with those of multinational companies in the S&P 1500, with the gap narrowing to 20%, the lowest level in the past five years. Specifically, in terms of the cash index, the cash index of Chinese companies decreased by 8.9% in 2023. The decrease in cash levels is partly attributed to the multiple cuts in the loan market报价利率 by the People's Bank of China last year, fluctuations in the stock market, and many other market changes, combined with a reduction in the operating cash flow of Chinese companies, an increase in dividend payments, and an increase in the intensity of debt repayment and share buybacks.

Operational capital differences and credit gaps are impacting the corporate ecosystem. It is worth noting that there is a significant difference in working capital efficiency between first-tier and second-tier Chinese companies, with a consistent operational efficiency gap of about 30-40 days. When the operating environment deteriorates, the gap will further widen. In addition, the gap between large enterprises and small and medium-sized enterprises in terms of loan and financing channels has widened.More Industries Show Improved Cash Conversion Cycles Over the Previous Year

In the industry sector, a positive signal is that out of 16 industries in 2023, 10 have seen improvements in their cash conversion cycles. Notably, the technology hardware, renewable energy, automotive and parts industries have significantly shortened their cash conversion cycles, while the pharmaceutical, construction engineering, and industrial sectors have experienced extensions.

Under the wave of cross-border e-commerce going global, e-commerce enterprises have been continuously adjusting and optimizing their cash conversion cycles over the past five years. In 2023, the efficiency of receivables collection has been enhanced, and the payment cycle has been extended. However, on the other hand, the inventory turnover days have been prolonged, reflecting the gradual saturation of the domestic e-commerce market. As Chinese e-commerce companies actively enter multiple overseas markets and invest in related niche areas, the cash flow management strategies of these companies have been included in the global transformation agenda of corporate treasury management teams.

The growth momentum of new energy vehicles has changed the landscape of the automotive and parts industry. The industry's cash conversion cycle has significantly improved over the past four to five years, mainly due to the continuous demand for Chinese brands, especially in the new energy industry chain, both domestically and internationally, as well as new business models, such as online direct sales and connected car-related services, which have brought faster settlement methods. Last year, new energy vehicle companies actively explored supply chain financing solutions, and the days of accounts payable turnover were significantly extended.

Benefiting from the "dual carbon" goals and favorable policy guidance, the development of the renewable energy industry has entered the fast lane. Although the cash conversion cycle was shortened by 21 days in 2023, the inventory turnover days increased by 8.4 days compared to the previous year, reaching the highest level in five years. The first-tier enterprises are facing short-term capacity saturation, and the pressure on corporate operating funds has also prompted more dialogue and exploration on optimizing operational capital solutions.

International experience can help Chinese companies optimize the management of working capital. Zhang Ding, General Manager of Global Corporate Payments, Asia-Pacific Trade and Working Capital, and General Manager of Asia-Pacific Trade and Working Capital Sales at JPMorgan Chase, analyzed that Chinese companies are more conservative than S&P 1500 multinational companies in using financial instruments to improve working capital without increasing corporate financial leverage. For example, S&P 1500 companies are more inclined to use supply chain financial tools to mitigate the negative impact of extending supplier payment terms, while also actively using accounts receivable financial tools to accelerate cash inflows and manage risks. In addition, multinational companies tend to be more proactive in considering and utilizing financial tools related to inventory management to ensure their core raw material inventory without affecting their own financial situation. These can provide a reference for Chinese companies seeking to improve the management of working capital.

Zhang Ding stated that companies of different sizes face challenges such as credit gaps, economic cycles, and the further expansion of geopolitical risks. Optimizing working capital and cash flow is crucial for the development of enterprises, with the most important focus being on paying attention to and strengthening the improvement of operational capital efficiency.

Share Your Experience